A Glance At The Intrinsic Price Of Turners Automobile Team Restricted (NZSE:TRA)

On this article we’re going to estimate the intrinsic cost of Turners Automobile Team Restricted (NZSE:TRA) through projecting its long run money flows after which discounting them to nowadays’s cost. The Discounted Money Go with the flow (DCF) fashion is the device we can practice to do that. It’s going to sound difficult, however in reality it’s somewhat easy!

Bear in mind regardless that, that there are lots of techniques to estimate an organization’s cost, and a DCF is only one means. Any person keen on finding out a little bit extra about intrinsic cost must have a learn of the Merely Wall St research fashion.

View our newest research for Turners Automobile Team

Step By means of Step Thru The Calculation

Contents

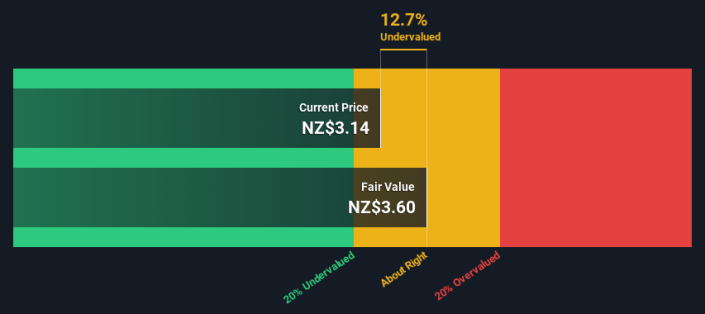

We need to calculate the price of Turners Automobile Team somewhat otherwise to different shares as a result of this can be a forte retail corporate. As an alternative of the use of unfastened money flows, that are exhausting to estimate and steadily now not reported through analysts on this trade, dividends in keeping with percentage (DPS) bills are used. This steadily underestimates the price of a inventory, however it could actually nonetheless be just right as a comparability to competition. We use the Gordon Expansion Type, which assumes dividend will develop into perpetuity at a price that may be sustained. The dividend is predicted to develop at an annual enlargement price equivalent to the 5-year moderate of the 10-year executive bond yield of two.1%. We then cut price this determine to nowadays’s cost at a value of fairness of 9.4%. In comparison to the present percentage fee of NZ$3.1, the corporate seems about honest cost at a 13% cut price to the place the inventory fee trades recently. Valuations are obscure tools regardless that, somewhat like a telescope – transfer a couple of levels and finally end up in a unique galaxy. Do stay this in thoughts.

Price Consistent with Percentage = Anticipated Dividend Consistent with Percentage / (Bargain Charge – Perpetual Expansion Charge)

= NZ$0.3 / (9.4% – 2.1%)

= NZ$3.6

Necessary Assumptions

We might indicate that an important inputs to a reduced money go with the flow are the cut price price and naturally the real money flows. A part of making an investment is bobbing up with your individual analysis of an organization’s long run efficiency, so take a look at the calculation your self and test your individual assumptions. The DCF additionally does now not imagine the conceivable cyclicality of an trade, or an organization’s long run capital necessities, so it does now not give a complete image of an organization’s possible efficiency. For the reason that we’re having a look at Turners Automobile Team as possible shareholders, the price of fairness is used as the cut price price, somewhat than the price of capital (or weighted moderate value of capital, WACC) which accounts for debt. On this calculation we have used 9.4%, which is in keeping with a levered beta of one.215. Beta is a measure of a inventory’s volatility, in comparison to the marketplace as a complete. We get our beta from the trade moderate beta of worldwide similar firms, with an imposed restrict between 0.8 and a pair of.0, which is a cheap vary for a strong industry.

SWOT Research for Turners Automobile Team

Power

Weak point

Alternative

Danger

Having a look Forward:

While essential, the DCF calculation should not be the one metric you have a look at when researching an organization. The DCF fashion isn’t an ideal inventory valuation device. As an alternative the most productive use for a DCF fashion is to check sure assumptions and theories to peer if they might result in the corporate being undervalued or puffed up. As an example, if the terminal cost enlargement price is adjusted somewhat, it could actually dramatically adjust the total consequence. For Turners Automobile Team, we have compiled 3 related sides you must assess:

-

Dangers: For example, we have discovered 2 caution indicators for Turners Automobile Team (1 is relating to!) that you want to imagine sooner than making an investment right here.

-

Long term Profits: How does TRA’s enlargement price evaluate to its friends and the broader marketplace? Dig deeper into the analyst consensus quantity for the approaching years through interacting with our unfastened analyst enlargement expectation chart.

-

Different Top High quality Choices: Do you prefer a just right all-rounder? Discover our interactive record of top quality shares to get an concept of what else is available in the market you will be lacking!

PS. Merely Wall St updates its DCF calculation for each and every New Zealander inventory each day, so if you wish to to find the intrinsic cost of some other inventory simply seek right here.

Have comments in this article? Involved in regards to the content material? Get in contact with us immediately. On the other hand, e-mail editorial-team (at) simplywallst.com.

This text through Merely Wall St is normal in nature. We offer statement in keeping with ancient knowledge and analyst forecasts simplest the use of an independent technique and our articles aren’t supposed to be monetary recommendation. It does now not represent a advice to shop for or promote any inventory, and does now not take account of your targets, or your monetary scenario. We goal to deliver you long-term centered research pushed through basic knowledge. Observe that our research won’t think about the most recent price-sensitive corporate bulletins or qualitative subject material. Merely Wall St has no place in any shares discussed.

Sign up for A Paid Consumer Analysis Consultation

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time whilst serving to us construct higher making an investment gear for the person traders like your self. Enroll right here

Supply By means of https://information.yahoo.com/look-intrinsic-value-turners-automotive-210010320.html