Rivian Car Inventory: Purchase The 52-Week Low (NASDAQ:RIVN)

Mario Tama

After the corporate introduced a $1.3 billion inexperienced convertible senior notes providing, Rivian Car, Inc. (NASDAQ:RIVN) set a brand new 52-week low this week.

The marketplace additionally declined in anticipation of Friday’s unencumber of work marketplace knowledge. The quick-term have an effect on of the roles document may push Rivian Car to new lows as buyers look ahead to a conceivable central financial institution reaction that incorporates swifter fee will increase.

Having mentioned that, those incidents have little or no to do with how Rivian Car operates, and for the reason that a number of chance property, equivalent to financial institution shares and cryptocurrencies, fell sharply the day prior to this, I consider there’s a window of alternative to load the truck with Rivian Car inventory.

Marketplace Sentiment Has Not anything To Do With Rivian Car’s Efficiency

Contents

Weak spot within the inventory marketplace can also be a possibility to load up on shares of businesses that are promising, function in expansion industries and feature low valuations. One such inventory, for my part unfairly penalized over the last few days, is Rivian Car.

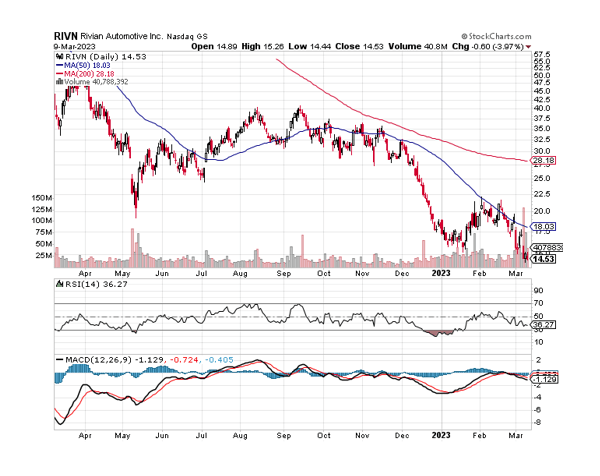

The inventory of Rivian Car has fallen to a brand new 52-week low of $14.21 because of a softening marketplace. Rivian Car isn’t oversold (but), however it’s going to really well transform so if Friday’s exertions marketplace document is available in stronger-than-expected, in line with the Relative Power Index. A sturdy exertions document would possibly pressure the central financial institution to start out elevating charges aggressively once more in 2023, which might be dangerous for shares.

RIVN inventory is at a turning level. Rivian Car was once rejected on the 50-day shifting reasonable line following two unsuccessful breakout makes an attempt in February, which is thought of as a detrimental chart sign. So, it is conceivable that the inventory will quickly hit new lows. RIVN might transform oversold and be offering a good higher funding alternative than it does this present day, although the RSI signifies that it isn’t but oversold.

Relative Power Index (Stockcharts.com)

Rivian Car’s $1.3 Billion Senior Notes Providing

Rivian Car’s value correction ultimate week was once pushed basically through two occasions that experience little to do with the corporate’s efficiency and execution within the EV marketplace.

Initially, Rivian disclosed its purpose to factor inexperienced convertible senior notes with a March 15, 2029 adulthood date with a view to lift $1.3 billion. There could also be an way to promote an extra $200 million of notes if there’s enough call for.

The corporate will be capable of spend money on new ‘inexperienced tasks’ like blank transportation and renewable power due to the senior notes, which can be redeemable on or after March 20, 2026.

Secondly, buyers ceaselessly pressurize dealers based on capital choices as a result of they’re desirous about a convertible providing’s possible for dilution. The proportion value of Rivian Car fell through 14.5%, however I consider buyers are overreacting to the providing.

On the finish of the fourth quarter, Rivian had greater than $11 billion in money, which is greater than sufficient to reduce manufacturing of its R1 truck and R1 SUV via 2024.

Robust Manufacturing Outlook For 2023 In Position

On its income name, Rivian Car supplied steering for a 2023 manufacturing goal of 50K electric-vehicles, suggesting that the corporate may greater than double its manufacturing YoY.

Rivian Car produced relatively greater than 24K electric-vehicles in 2022, falling simply wanting the corporate’s 25K manufacturing goal.

In keeping with rumors, Rivian Car has internally floated a 62K manufacturing goal for 2023, which might constitute a 24% building up over the in the past introduced goal.

Large Gross sales Ramp Forward In 2023 And 2024

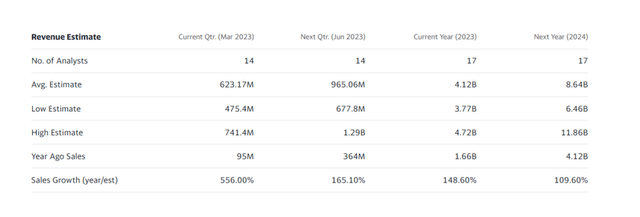

The marketplace recently anticipates gross sales expansion of 149% in 2023 and 110% in 2024, translating to a possible gross sales quantity of $8.64 billion in 2019. The electrical-vehicle producer bought 1.66 billion bucks’ price of its kind of 24K electric-vehicles in 2022.

With a gross sales forecast of $8.64 billion, assuming the marketplace is moderately correct, the worth of the electric-vehicle corporate is now 1.45x gross sales (in keeping with 2024 gross sales). Since Rivian Car’s preliminary valuation was once more than 10x gross sales, I believe the present gross sales a couple of is a brilliant deal.

Rivian Car’s gross sales a couple of of one.45x is a scouse borrow for an EV corporate this is expected to greater than double manufacturing this yr (plus an implied 24% upside in keeping with the interior forecast).

Income Estimate (Yahoo Estimate)

Why Rivian Car May just See A Decrease Valuation

Rivian Car might face issues of its provide chain, and different financial tendencies (equivalent to inflation) could also be adverse to the efficiency of the EV corporate and shopper call for in 2023.

The closure of Silicon Valley Financial institution would possibly impact the monetary business extra extensively and result in every other monetary disaster. In spite of everything, if buyers’ chance aversion is impacted through an intensifying banking disaster, EV shares might stay unpopular.

My Conclusion

The $1.3 billion inexperienced convertible senior observe providing and the inventory marketplace selloff forward of Friday’s process document are the 2 contemporary occurrences that experience led to Rivian Car’s inventory to say no and hit new 52-week lows.

As each scenarios have little to do with Rivian Car’s efficiency and technique within the EV marketplace, I consider buyers are overreacting in each circumstances.

The manufacturing forecast for 2023, for my part, is affordable (particularly the person who was once internally communicated), and the EV corporate remains to be expected to ship an excellent ramp in gross sales this yr and the next yr.

Because the inventory of the corporate is recently buying and selling at 52-week lows and could also be oversold within the close to long term, I in truth consider that Rivian Car is a robust funding. The extra it drops, the extra I purchase.

Supply By means of https://seekingalpha.com/article/4587461-rivian-automotive-the-market-is-scared-buy-the-52-week-low